Consumer Price Index Scenarios Covid19 Supply Chain Disruption Shock

Exoshock Insights on the Global Economy

Exoshock is using its model to monitor Covid-19 effects on the global and regional economies

Recent global and regional events associated with Covid-19 and the spread of this deadly virus has shown the unpredictable impact of this virus on the economy and much wider implications on multiple aspects of human life. According to WorldOMeter, this has reached 22,028 deaths and 487.452 cases globally, and it keeps growing exponentially.

Governments are locking down on the movement of citizens worldwide, in order to prevent the spread of this deadly virus. Tuesday 24th, the Guardian reported that about 20% of global population was already locked down in their homes. Shortly after, BBC reported that India is planning a 21 days lockdown for 1.3 billion people with immediate effect, adding another 17% of the global population in lockdown.

Following our first article Exoshock Model helps assess global impact of Covid-19 on Real Commodity Prices Indices we now provide further highlights on the possible state of the Consumer Goods and Services Industry in the next period and potential instability that could last way beyond 2020 and 2021.

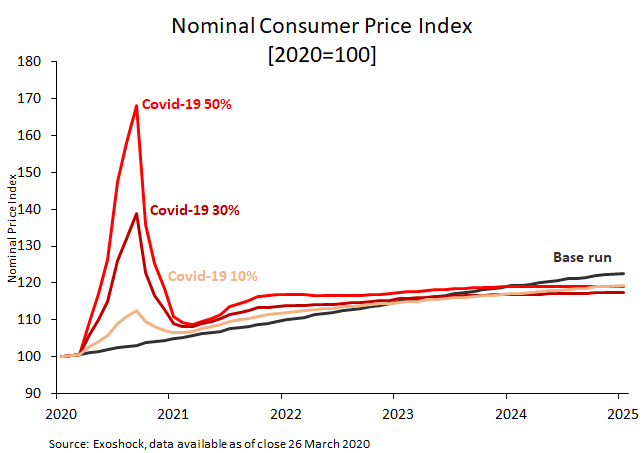

Central Banks only option is to increase money supply to mitigate supply chain disruption risk.

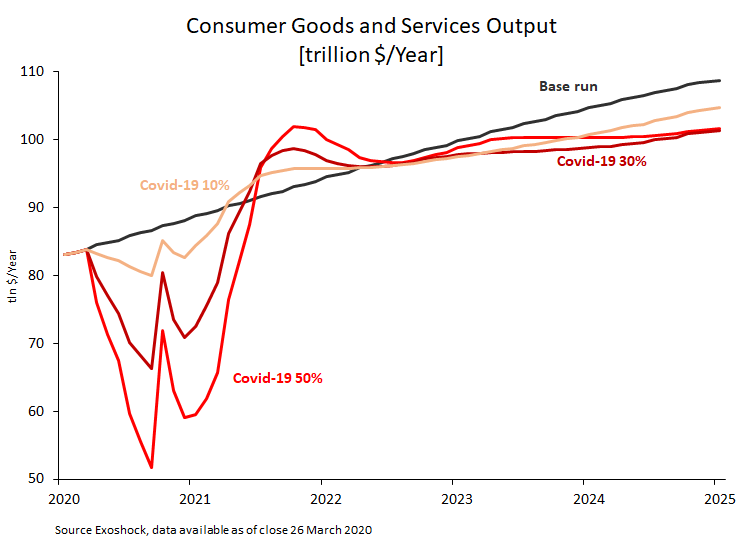

We use the Exoshock model to test and compare scenarios that simulate the hypothesis of leaving 10%, 30% and 50% of the global workforce under lockdown and out of production for 6 months.

In this scenario Exoshock assumes that demand follows the same trend as in the past. In further article we will examine the demand side in more detail and allow for different analysis.

The results are presented in the charts below.

The worst impacted sector would be the Consumer Goods and Services sector, resulting in a 38% collapse of output globally when reducing labour by 50% over a 6-month period.

Exoshock predicts the impact, although violent in the meantime, will not last more than 2 years.

The impact of loss of labour would result in the overall price dynamics to rise sharply to +70% levels over the 6-month shock period, leading to less sales more business failures and economic negativity.

However, returning labour force (i.e. lifting of lockdown and return to normality) would generate a rise in output, causing a drop in prices and instability across the supply chain. If managed correctly, the negative macro-economic impact of the covid-19 pandemic could be neutralized in less than 2 years.

This is a call to the UK Government and the Bank of England to find the correct trade-off between economic cost and UK economic stability over the time of this crisis. Will the UK and the governments around the world apply the correct policy to mitigate the risk of the worse case scenario?

Exoshock is an interactive, hybrid modelling platform, which allows global organisations to reduce critical business risks to real-world events. The Exoshock model accurately simulates economic reality, capturing general market trends and calibrated against historical data. It’s an ideal solution for “forecasting” & “scenario planning” for all economic activity including impacts of Covid-19 and environmental variables.