Western world consumer demand reduction & the rise of Food Real Price Index and Food Poverty

Exoshock Insights on the Global Economy

Exoshock is using its models again to monitor Covid-19 effects on the global and regional economies

Among the major concerns for the impact of Covid-19 on the global economy there is the food supply disruption leading to food insecurity problem. While some countries might enjoy a healthier economic system and the shock might not be felt as strong, weaker and underdeveloped economies might end up in social unrest for this reason.

The International Monetary Fund is already proposing policies to mitigate the risk of food supply chain disruption. While developed economies saw their shops literally robbed due to consumer purchases in the short term, entire countries such as Bangladesh have to rely for the 35% of their food import from abroad. This might be disrupted by locking down people at home in other countries. According to the Citizen newspaper, the big loser will be Africa. The African Development Banks Group has estimated that Covid-19 could cost the continent a gross domestic product loss of between $22.1 billion and £88.3 billion due to a lack of exports. FAO also estimates approximately 800 undernourished people worldwide, more than 1 in 10 people walking on Earth.

In this article, we test the Exoshock global model to rise awareness on the possible pattern of the real Food price Index (FPI) and implications for food poverty and chaos. The FPI is heavily influenced by wheat and rice prices, and often determines the threshold between famine and speculation worldwide.

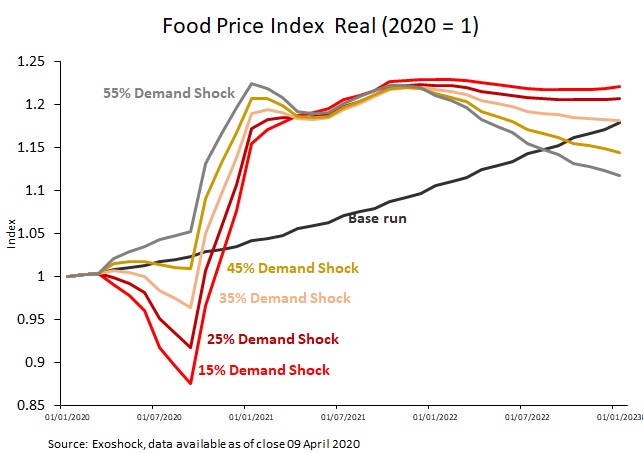

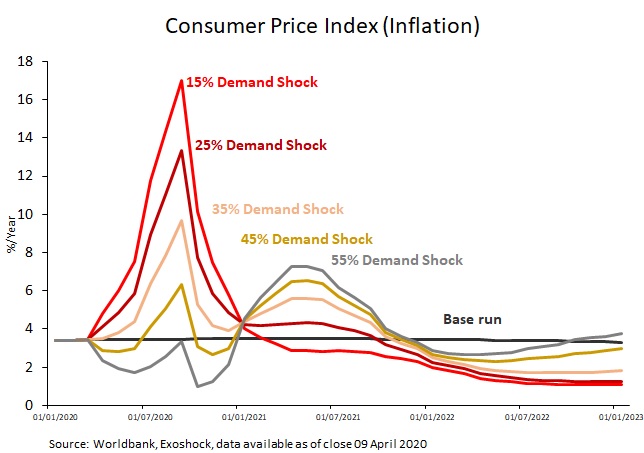

The analysis is proposed by combining a fixed 25% workforce supply shock with a sensitivity analysis on the demand side. The sensitivity on demand is proposed at 15%, 25%, 35%, 45% and 55% household consumer demand shock. All scenarios assume shocks for the duration of 6 months. This follows up on our previous articles where we tested supply and demand shocks separately. It is worth noting that while workforce supply shock reduction is applied to ALL the sectors of the economy, the demand shock is applied to the goods, services and housing construction only. As a result, food demand is preserved.

The results are shown in the charts below.

Food can be overpriced or underpriced depending on our decision to cut Consumer Demand

In comparison to the base line scenario, Real Food Price can vary from a -12% reduction in case of a -15% drop in consumer goods demand to a +5% increase when demand decreases by -55% by the end of the six -month period. These are both followed by sudden increase peaking around the beginning of 2021 in all scenarios and remaining higher at least for the 18 months afterwards. Why is this happening? The result could appear counterintuitive, but we can explain it in detail.

First of all, the Real Price of Food is adjusted by the average global inflation rate. Inflation is largely explained by the consumer goods price, where a workforce demand shock would generate inflation to rise (see Consumer Price Index Scenarios Covid19 Supply Disruption Shock). When a -55% goods demand occurs the overall economy would rather move towards deflation (see Global Demand Shock, Deflation & Hyperinflation). Since food demand is assumed not to vary much in absolute terms, this implies that the real price of food would result in relative increase in comparison to the rest of the economy when inflation decreases, and rather decrease in real terms when inflation rises. In fact, when demand shock is at the 15%, it appears that the effect of inflation increase due to the supply shock is much greater than the deflation cause by demand reduction. The result would be rise in inflation rate, and a relative reduction of the Real Food Price Index over the time of the shock.

All other runs provide a sense of where the interference between a supply and demand shocks can interact among each other.

When supply comes back to work and demand is repristinated at the end of the shock period, prices will be oscillate due the disruption in the global supply chain following the dynamics well explained in the previous articles.

The consumption behaviour of the developed world during Covid-19 will continue across the supply-chain ultimately hitting those who are most vulnerable to the food price dynamics.

The Food and Agriculture Organization estimates there are about 800 million people undernourished today. This report highlights that the likelihood for this number to rise significantly is very high, linked to starvation and food riots around the world possibly the like of which we have never seen!

Exoshock is an interactive, hybrid modelling platform, which allows global organisations to reduce critical business risks to real-world events. The Exoshock model accurately simulates economic reality, capturing general market trends and calibrated against historical data. It’s an ideal solution for “forecasting” & “scenario planning” for all economic activity including impacts of Covid-19 and environmental variables.