Global Demand Shock, Deflation & Hyper-inflation

Exoshock Insights on the Global Economy

Exoshock is using its model to monitor Covid-19 effects on the global and regional economies

The lockdown of UK population due to Covid-19 spread during the last week has become a particular concern for the government while the death toll sharply rises. Such an intervention also impacts economic stability in this unprecedented crisis

While people are asked to work from home there is also a fear of rapidly falling consumer inflation. This is likely due to the high rise in unemployment and lack of income for the major developed economies as indicated by US Jobless Claims. This indicator moved from an average of 280k people at the beginning of March to a staggering 6.6 million on 2nd April an all-time record by a exceptionally wide margin. This, coupled with the inability of households to leave their homes, purchase many discretionary items, or travel explains the deflation recorded in markets in the last few weeks.

In this article we provide a sensitivity analysis by reducing household demand for varied lengths of time to quantify the impact a prolonged lockdown. This is a follow up on the previous article Covid19 Supply Chain Disruption Shock where we provided a scenario comparison of workforce supply shocks.

The uncertainty linked to the impact of COVID-19 on markets and economy is significant. A good early indicator for the current economic situation is the IHS Markit PMI surveys (Purchasing Managers Index).

The PMIs suggest a reduction in demand, likely to trigger deflation in the global economy in the short-term. In the second phase, post-lockdown, a sudden return of demand coupled with disrupted supply chains, is likely generate serious instability in the global economy, including the risk of hyperinflation and recession for both developed and emerging economies worldwide.

Keeping the lock-down to less than 3 months might prevent hyperinflation

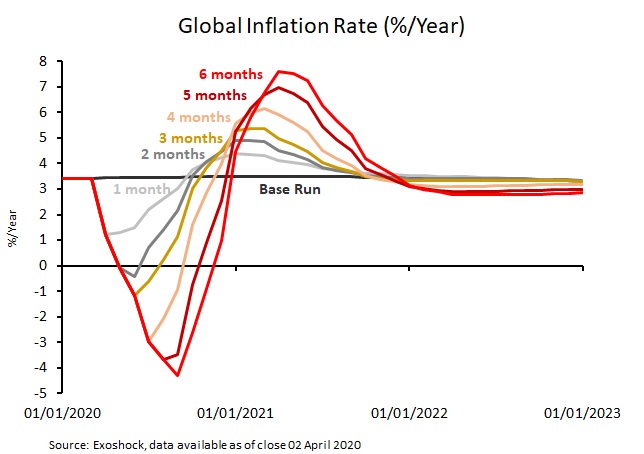

In this scenario, we made an assumption on the potential reduction in demand of approximately 25%. Since we are uncertain on the duration of the Covid-19 lockdown, we have created a sensitivity analysis ranging from 1 month to 6 months, addressing the possible behavior of the global economy over this time. The sensitivity is shown in the chart below.

Starting from a relatively stable period in 2019 with an average inflation rate of 3.4% globally, the reduction in demand can help explain the recent deflationary trends in the global economy. The longer the lockdown, the greater risk of a hyperinflation scenario unless governments manage the situation with an awareness on large system delays existing in the global industrial system.

Understandably, the chart shows that the longer the recession the longer the time required from the economy to return to stability. The consequences of a demand shock lasting 6 months would mean the world economy would not normalize until 2022.

Interestingly, a lockdown lasting less than two months has a fairly minimal impact on the economy, it’s when you step over the 2-month lockdown period that the real damage is done, as the Exoshock system is modelling real damage to global supply chains.

Exoshock is an interactive, hybrid modelling platform, which allows global organisations to reduce critical business risks to real-world events. The Exoshock model accurately simulates economic reality, capturing general market trends and calibrated against historical data. It’s an ideal solution for “forecasting” & “scenario planning” for all economic activity including impacts of Covid-19 and environmental variables.